All Categories

Featured

Table of Contents

Any kind of continuing to be excess comes from the proprietor of document promptly before the end of the redemption duration to be asserted or assigned according to legislation - property overages. These sums are payable ninety days after implementation of the deed unless a judicial action is set up throughout that time by an additional claimant. If neither claimed nor designated within 5 years of day of public auction tax sale, the overage will escheat to the basic fund of the regulating body

386, Sections 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Section 1, routed the Code Commissioner to change all recommendations to "Register of Mesne Conveyances" to "Register of Deeds" wherever appearing in the 1976 Code of Regulations. SECTION 12-51-135. Elimination of erroneously issued warrants. If a warrant, which has been filed with the clerk of court in any type of area, is identified by the Division of Income to have been issued and filed at fault, the clerk of court, upon notification by the Division of Revenue, must eliminate the warrant from its publication.

Which Course Should I Take To Become Proficient In Revenue Recovery?

201, Component II, Area 49; 1993 Act No. 181, Area 231. AREA 12-51-140. Notification to mortgagees. The arrangements of Areas 12-49-1110 via 12-49-1290, inclusive, connecting to notice to mortgagees of suggested tax obligation sales and of tax obligation sales of properties covered by their particular home loans are taken on as a part of this chapter.

Code Commissioner's Note At the instructions of the Code Commissioner, "Areas 12-49-1110 via 12-49-1290" was replacemented for "Areas 12-49-210 through 12-49-300" because the last areas were repealed. SECTION 12-51-150. Authorities may void tax sales. If the authorities accountable of the tax obligation sale discovers before a tax title has passed that there is a failing of any activity required to be correctly done, the official might nullify the tax sale and refund the quantity paid, plus rate of interest in the quantity really gained by the county on the quantity reimbursed, to the effective prospective buyer.

BACKGROUND: 1962 Code Area 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Section 14; 2006 Act No. 386, Areas 35, 49. Code Commissioner's Note At the direction of the Code Commissioner, the first sentence as amended by Area 49.

HISTORY: 1962 Code Area 65-2815.15; 1971 (57) 499; 1985 Act No. 166, Section 15; 2006 Act No. 238, Area 3. B, eff March 15, 2006. AREA 12-51-170. Contract with area for collection of taxes due town. A county and district may get for the collection of local tax obligations by the area.

Foreclosure Overages

He may employ, designate, or designate others to carry out or accomplish the arrangements of the phase. HISTORY: 1962 Code Section 65-2815.16; 1971 (57) 499; 1985 Act No. 166, Area 16.

Tax liens and tax acts commonly cost greater than the area's asking cost at public auctions. On top of that, the majority of states have regulations impacting bids that exceed the opening bid. Payments above the county's benchmark are referred to as tax obligation sale overages and can be profitable investments. The details on overages can develop issues if you aren't conscious of them.

In this post we inform you how to obtain lists of tax obligation overages and make money on these possessions. Tax obligation sale overages, additionally recognized as excess funds or exceptional proposals, are the quantities proposal over the beginning cost at a tax obligation auction. The term refers to the dollars the financier invests when bidding process above the opening quote.

What Is The Most Popular Course For Training Resources Investing?

This starting number mirrors the taxes, costs, and passion due. After that, the bidding starts, and several capitalists drive up the price. You win with a quote of $50,000. The $40,000 boost over the original proposal is the tax obligation sale excess. Declaring tax sale excess implies obtaining the excess money paid throughout an auction.

That stated, tax sale overage insurance claims have shared attributes across many states. During this duration, previous proprietors and home loan owners can get in touch with the area and get the excess.

What Are The Best Profit Maximization Training Platforms?

If the period expires prior to any interested parties claim the tax sale excess, the county or state normally soaks up the funds. Previous proprietors are on a stringent timeline to case excess on their residential or commercial properties.

Bear in mind, your state legislations influence tax obligation sale excess, so your state may not allow capitalists to gather overage interest, such as Colorado. Nevertheless, in states like Texas and Georgia, you'll gain interest on your whole proposal. While this aspect does not imply you can assert the excess, it does help alleviate your costs when you bid high.

Remember, it could not be legal in your state, suggesting you're limited to collecting rate of interest on the overage - market analysis. As stated over, a financier can find methods to profit from tax obligation sale excess. Because rate of interest earnings can relate to your entire proposal and past owners can declare overages, you can leverage your knowledge and devices in these circumstances to make best use of returns

A critical element to bear in mind with tax obligation sale excess is that in the majority of states, you just need to pay the region 20% of your complete proposal in advance. Some states, such as Maryland, have legislations that exceed this guideline, so once again, study your state laws. That said, a lot of states adhere to the 20% policy.

What Are The Most Effective Courses On Real Estate Workshop?

Rather, you only need 20% of the quote. If the residential property does not redeem at the end of the redemption duration, you'll need the staying 80% to get the tax act. Because you pay 20% of your quote, you can gain rate of interest on an excess without paying the full cost.

Once more, if it's lawful in your state and region, you can collaborate with them to assist them recover overage funds for an additional charge. You can gather interest on an overage quote and charge a charge to streamline the overage case procedure for the previous owner. Tax obligation Sale Resources just recently launched a tax sale overages item particularly for individuals curious about seeking the overage collection organization.

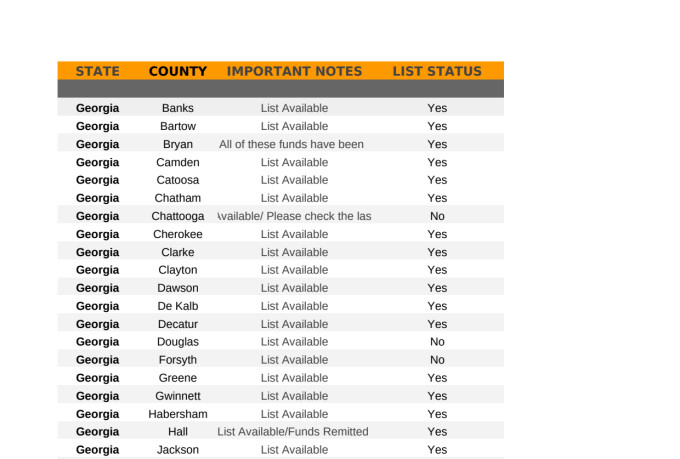

Overage enthusiasts can filter by state, area, building type, minimal overage quantity, and maximum excess amount. Once the data has been filtered the collectors can make a decision if they wish to add the skip mapped data plan to their leads, and then pay for just the confirmed leads that were discovered.

What Is The Most Important Thing To Know About Real Estate Claims?

In addition, just like any kind of various other financial investment strategy, it supplies special pros and disadvantages. profit maximization.

Latest Posts

Buying Homes With Delinquent Taxes

Tax Lien Investment Bible

Investing In Tax Liens